Onchain Market Indicators

Price Forecast Tools

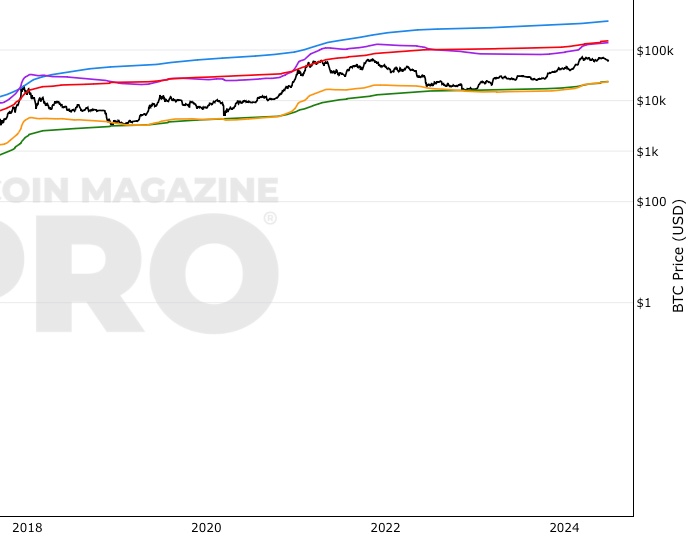

Top Cap, Terminal Price, Delta Top, CVDD, Balanced Price

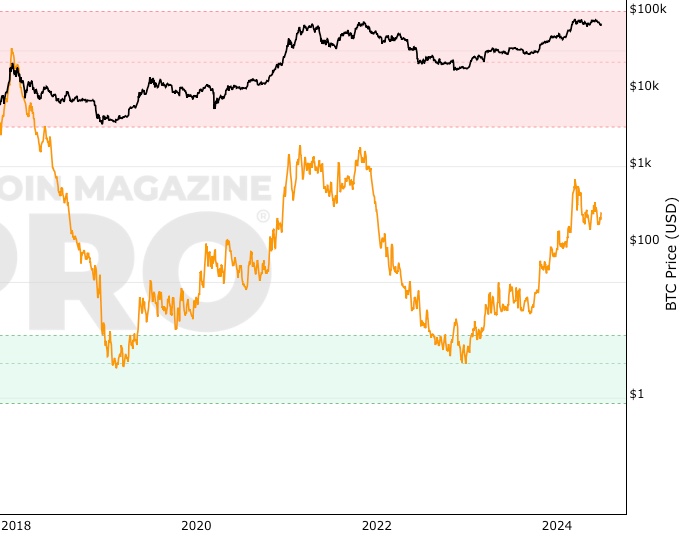

MVRV Z-Score

Pulls apart differences between Market Value and Realised Value to identify market cycle highs and lows.

RHODL Ratio

On Chain Indicator using Realized HODL Ratio’s to identify cycle high price tops.

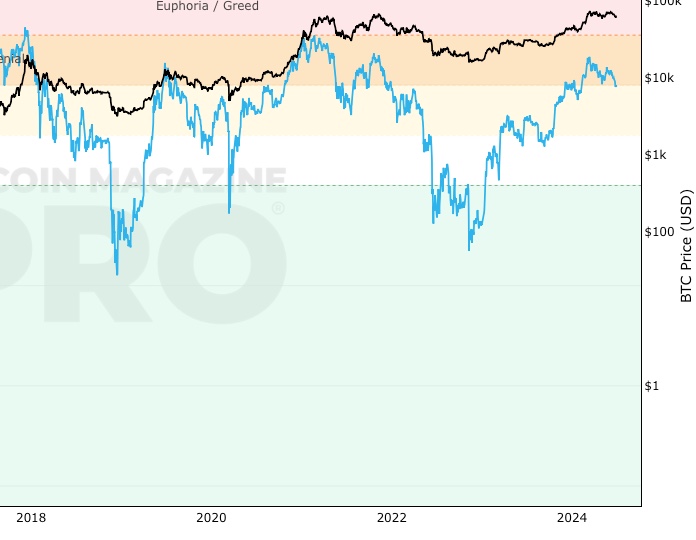

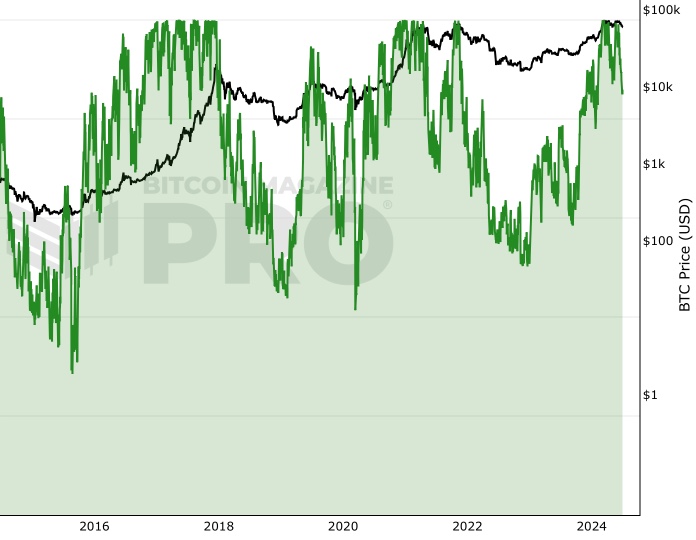

Net Unrealized Profit/Loss (NUPL)

On-chain indicator for investor sentiment market stages

Reserve Risk

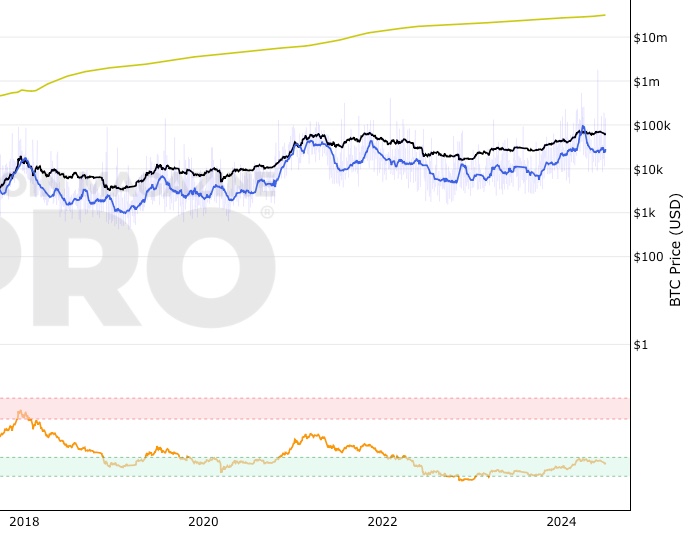

Long term Bitcoin investor confidence relative to Bitcoin price.

AASI (Active Address Sentiment Indicator)

Comparing change in price with change in number of addresses to determine if Bitcoin is over/undervalued in the short term.

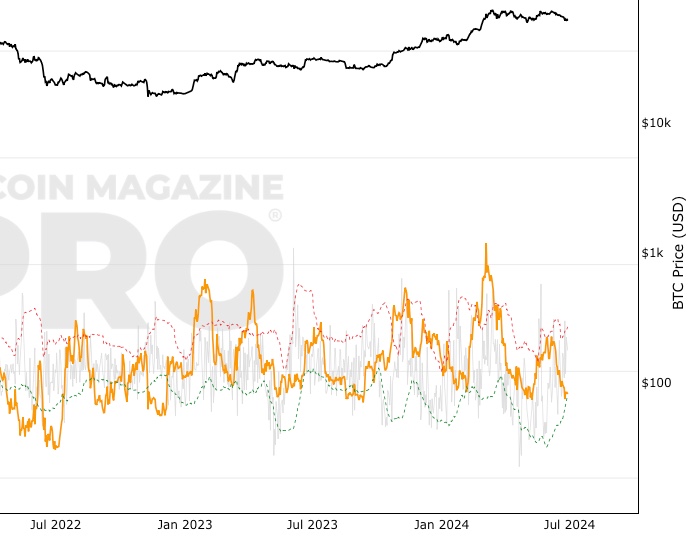

Advanced NVT Signal

This adaptation of NVT Signal adds standard deviation bands to identify when Bitcoin is overbought or oversold.

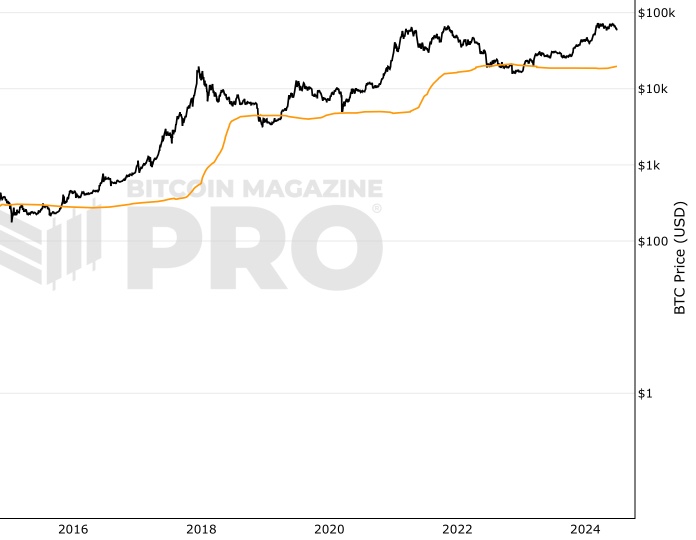

Realized Price

The aggregate cost-basis of all bitcoin.

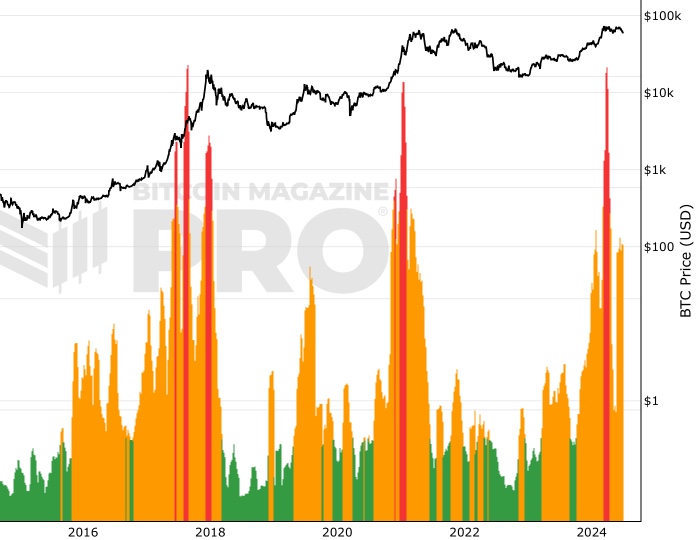

Value Days Destroyed (VDD) Multiple

Identifies Bitcoin cycle highs by comparing near-term spending velocity with yearly average of spending velocity.

CVDD

Pricing model for identifying Bitcoin bear market lows.

Top Cap

Pricing model for identifying Bitcoin bull market highs.

Delta Top

Pricing model for identifying Bitcoin bull market highs.

Balanced Price

Pricing model for identifying Bitcoin bear market lows.

Terminal Price

Pricing model for identifying Bitcoin bull market highs.

Long-Term Holder Realized PriceNew

Average price at which long-term investors have purchased their Bitcoin.

Short-Term Holder Realized PriceNew

Average price at which short-term investors have purchased their Bitcoin.

Percent Addresses in ProfitNew

The Percentage of Bitcoin Addresses in Profit.

Percent Addresses in LossNew

The Percentage of Bitcoin Addresses in Loss

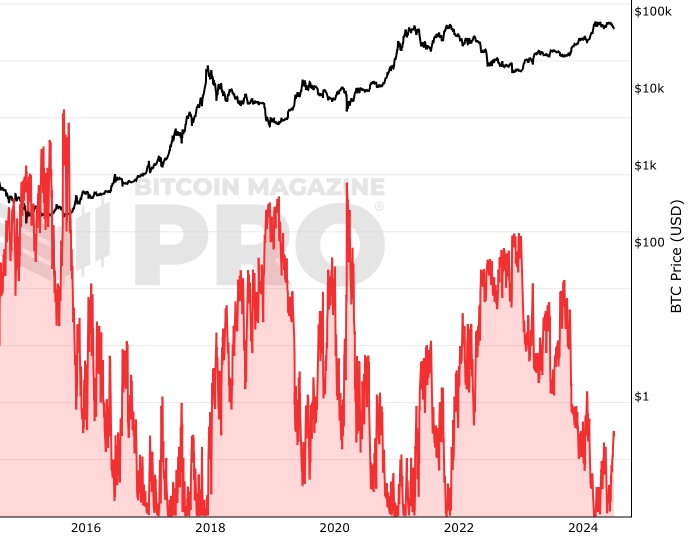

Puell Multiple

Relationship between daily bitcoin issuance and price.

Please note, the indicators above are experimental. There is no guarantee certain rules within each model will continue to apply as Bitcoin progresses along its adoption journey. Any information on this site is not to be considered financial advice. Please review the Disclaimer section for more information.